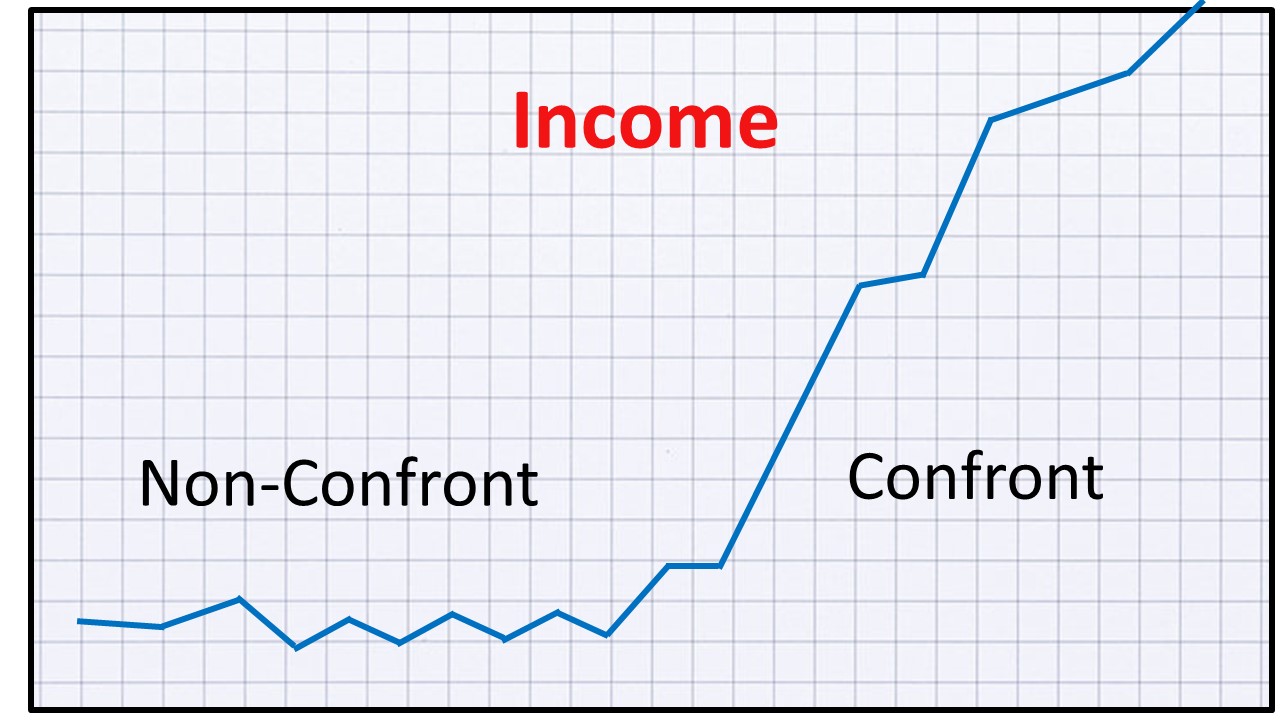

Confront = Rich, Non-Confront = Poor

Steve has the golden touch. Everything he does makes money. As an employee at a furniture store, he gets fast promotions and raises. After five years, he is the top manager and makes a deal with the owner to buy the business. He makes several improvements and triples the income. He has no debt, saves money every month and has a lot of fun.

Andy is broke. He works at the same furniture company, but never gets ahead. He can’t remember his last raise and is terrified of starting a business. He spends more than he makes, so his debt amount steadily increases. Because he constantly worries about money, he has health problems, as well.

What is the greatest difference between Steve and Andy?

“Man is having trouble with finance? Obviously, he is unwilling to confront* money.” — L. Ron Hubbard (*Note: ”Confront” has two common definitions: 1) meet face-to-face in hostility or defiance. 2) face up to and handle problems with ease and comfort; to be courageous but relaxed. In this article, we are using the second definition.)

What Does this Mean?

To resolve money troubles, you confront or face all aspects of money: how to make it and how to manage it. You have no resistance, no hesitation and no emotion regarding money. You easily face and handle your finances.

For example, you can probably confront an apple. The apple does not scare you or upset you. You can easily control and enjoy the apple.

However, maybe going for a better job, starting a business or investing money is not easy for you to face. As a result, you have less money.

However, maybe going for a better job, starting a business or investing money is not easy for you to face. As a result, you have less money.

When you can confront something completely, with zero fear, you see improvement. It can be enjoyable!

In our example above, Steve is a financial success because he faces all financial difficulties. For example, he fearlessly sells big packages of office furniture to the toughest customers.

Andy gets so nervous when talking to big-shot customers that he prefers to stay in the back of the store. If he were willing to confront tough customers, he would conquer his fear and earn more money.

What Is Non-Confront?

Non-confront comes in many forms: fear, avoidance, shyness, laziness, procrastination, terror, pretense, anxiety, stress, worry, upsets, forgetfulness, disorganization, hatred, lies, shame, blame, regret, critical thoughts and excuses.

When it comes to money, do you experience any of these feelings?

What Is Confront?

The ability to face danger, pain, fear, crime, terror, attacks and horror with confidence.

Willingness to confront goes by many names: bravery, fearlessness, guts, boldness, spunk, daring, fortitude, warrior, hero, adventurer, voyager, superstar, grit, gallantry, victor, winner and power.

To get rich, you need to confront everything about finances. EVERYTHING.

10 Ways High Confront Makes You Rich

- You have confidence. “I can get a better job.” “I can talk about my money with experts.” “I can pay my bills, learn about investments and be honest.”

- High confront removes doubt. “I know what I’m doing.” “I’m going in the right direction.” “I am good enough.”

- With good confront, you see things as they are. Aggressive people do not look dangerous. Sales people do not look like con artists. Opportunities do not look like risks.

- Confront removes excuses. “I can make it go right even if no one else can.” “The economy has nothing to do with my success.” “I see no reason I can’t double my income.”

- High confront prevents mistakes. You say the right things to the right people. You know who to trust. You pick the best opportunities.

- When you face dangers, you are calm and professional while others are confused and upset.

- High confront helps you connect with powerful people and get their support. They do not intimidate you or make you shy. They like your level of confront.

- You have no problem facing difficult paths and tasks that lead to your financial goals.

- You do not waste time asking for others’ opinions. You make your own decisions.

- You take action. You do not sit on your hands and worry.

Three Action Step Recommendations

Step 1: Identify the areas of money you are not confronting.

Step 2: Boost your confront for these areas.

Step 3: Make more money!

Step 1: Identify All Money Matters You May Not Be Confronting

What about money is hard for you to face? What makes you confused or nervous?

These 20 questions can help you find which areas of money you need to face and handle. There may be several.

- How much money do you owe?

- How much loan interest do you pay per month?

- How much money do you spend per month? On what?

- How much money do you waste per month?

- Do you know how much money you have?

- Do you avoid preparing tax or other legal documents?

- Are you not keeping your promise to pay money to someone?

- Are you avoiding anyone who owes you money?

- Are you involved in financial disagreements?

- What are you doing with money that you should not be doing? That you should be doing?

- Do you have a long-term financial plan?

- What work skills should you improve?

- How could you produce a better service or product?

- What about your income are you avoiding?

- What do you lie about regarding money?

- What bad habits do you have with money?

- What scares you about money?

- What are you putting off?

- What do you hate about making money?

- What steps do you need to do that are difficult to face?

Step 2: Boost Your Confront

Select one thing you need to confront. Something that would boost your income if you could confront it.

Now increase your confront for it. One of these three methods may help you.

Confront Booster #1: Dip Your Toe

Confront Booster #1: Dip Your Toe

A common ingredient to all fears is they make you avoid them. The more you avoid them the scarier they become. Yet if you take one tiny step and dip your toe into the puddle of fear, you may discover it’s easier to confront than you imagined!

For example, before you jump into a swimming pool, you stick in your hand or toe to check the water temperature. Diving into the water is easier if you know what to expect, right?

Three Examples

1. Whenever you face a fear, the first few seconds can be the most difficult.

Once you start an important sales meeting, you find it’s not such a big deal.

Once you start to calculate your debts, you find you can actually get accurate numbers.

Once you start your new business, you realize you will be fine.

So just starting to face the fear, just taking one single step, can boost your confront enough to take you through the challenge.

2. You “give it a try just for fun” to see how hard it might be.

You are interested in a side business designing websites. You pay $10 for a month with a website host. You follow their first set of instructions and register a domain name. You continue following their instructions and just have fun with it. All you have at risk is $10. You are excited to discover you can do it!

3. You follow and assist someone who is very successful.

You want to sell mansions. You need contacts and relationships with rich people, but you are new to the industry. You find the most successful real-estate agent in town. You ask to apprentice under her and assist her at no pay. She agrees.

You go to social events with her. You drive her car for her and carry her stuff. You assist her with paperwork and scheduling. You watch everything she does.

Soon, you find new clients for her. You add to the conversations. You help her make a few sales. Your toe is in the water.

You realize you can win this game now. You move to another area so you never step on her toes.

Action Steps

1. Pick a fear.

2. Work out a way to dip your toe into the fear.

3. Dip your toe!

4. Continue to dip and pull out your toe, over and over until your fear is replaced by courage.

Confront Booster #2: Let the Fear Exist

Confront Booster #2: Let the Fear Exist

Instead of fighting, resisting or trying to control the source of a fear, just let it be there. Decide to do nothing about it. Just leave it alone.

Two Examples

1. Julie’s café is suffering because she is afraid of her staff members.

She works hard to make them look and act the way she believes they should. “Steve, you need to use a quieter voice.” “Sheila, can you change your hair back to brown instead of orange?”

Yet she cannot confront them when they push back. She can’t sleep at night when she hears them ridicule her behind her back. So she fires anyone who does not conform.

She tries to only hire employees who do not scare her. Unfortunately, these types of employees are also afraid much of the time and are poor restaurant workers. They mess up customer orders, take a long time to cook dishes and give lots of excuses for not showing up as scheduled. As a result, Julie’s restaurant reviews are horrible and Julie wears too many hats. She is going broke.

Julie realizes she has to boost her confront. She decides good restaurant employees are who they are and she should let them be who they are. She hires two outgoing servers who are loud and cheerful. Julie bites her tongue, lets them be who they are and stops trying to make them be quiet and “professional.” They take pride in their ability to make customers laugh and how they get the food orders exactly right.

Julie hires an obnoxious cook who uses a lot of profanity, but he is fast and precise. At first, Julie is afraid of him and frustrated by his language, but decides to let him be who he is as long as he follows or improves her recipes.

Julie’s customers love the servers, are impressed with their meals and enjoy the fast service. Julie’s positive reviews mount up and her tables are kept full. Best of all, she is no longer afraid of her staff.

2. Jamal’s boss is an antisocial jerk. When he orders Jamal to do an impossible task, Jamal tries to explain how it cannot be done. His boss demands he do it anyway. His boss then criticizes him for failing. Jamal tries to reason with his boss, go around his boss or avoid his boss, but gets yelled at instead. If it was not for this boss, Jamal would love his job, but he hates this boss.

Jamal decides to try this courage booster and lets his boss be a jerk. When he gets a difficult order, he says, “OK” and simply does his best. When his boss yells at him, Jamal just listens, allows his boss to be the way he is and stops worrying about it. His fear reduces.

One day, his boss says, “You’re doing a sufficient job” and gives him a nod. Jamal is shocked! He goes home and celebrates. His fear is gone.

Action Steps

1. Pick something you cannot confront.

2. Look at it or think about it without doing anything about it.

3. Let that cause (person, object, reason) exist exactly as it is. Stop resisting it, hating it, trying to influence it, change it or otherwise control it in any way.

Just let it be there. Give the person or situation permission to be as it is. Allow it to continue without any influence from you.

4. Focus on the things that you CAN control. For example, your attitudes, habits, responsibilities, decisions, plans and responses to situations and people.

Confront Booster #3: Add Knowledge and Skills

Confront Booster #3: Add Knowledge and Skills

To make more money, you not only need the knowledge and skills to produce your valuable products or services, you need financial skills like how to negotiate deals, make sales, track your income, pay bills, use banking systems, file government forms and more.

If you do not have these skills, your confront will be low. You do not know what you are doing.

As soon as you gain the proper skill, your confront jumps up and you enjoy financial success.

Two Examples

1. You start a new job and are immediately swamped with tasks you cannot do. You are terrified that someone will eventually discover you are incompetent and fire you. You will be embarrassed, leave in disgrace and be broke.

You decide to fake it and pretend to know what you are doing. Of course, this just increases your fear and wastes time.

So you decide to learn the skills you need to succeed with the job ASAP. You make a list

1. Skill to use the company’s computer system.

2. Skill to gather the data you need for reports.

3. Skill to write reports.

You find the instruction manuals for the computer system, watch your coworkers, read dozens of sample reports and, within a few days, learn these three skills. Your fear is eliminated and you are on your way to succeeding with this job.

2. As a new business owner, all goes well, at first. But then a few employees want raises and you give it to them without realizing you cannot afford the costs. You soon discover you have no money in the business checking account. You have no money to pay your loan payment, suppliers or landlord. An accountant also wants thousands to prepare your tax forms.

You are terrified you have made a huge mistake and will lose everything. You cannot sleep as you imagine the horrible consequences of failing.

So you get smart and list the skills you need to manage a business. You stay up late to learn these skills. As a result, your non-confront is replaced with success.

Action Steps

1. What is an area of non-confront you could confront IF you learned more about it or gained a new skill?

2. Learn the skill related to this fear by watching videos, reading guidelines, taking classes or hiring a tutor.

3. Practice your new skill until you confront the subject.

4. Pick other fears that are based on missing skills and learn these skills.

Four Reasons You May Not Be Able to Boost Your Confront

Four Reasons You May Not Be Able to Boost Your Confront

1. Your mind is clouded with substances like alcohol, recreational drugs or unnecessary medications. These substances can prevent you from seeing the reality of the world and your financial condition.

Without mind-altering substances in your system, your ability to confront your finances and make brilliant decisions is improved.

2. Someone, like an antisocial, blocks you from facing them or financial subjects. Such people worry you might succeed financially and not be dependent on them.

You succeed once you face and handle these people so they get out of your way.

3. You are distracted by “the news.” The news media spends millions trying to make you believe the world is dangerous and difficult to confront. If they succeed, you give them, and their advertisers, more of your valuable time and attention.

If you disconnect from news sources, and focus on your success, you soon realize the world is not dangerous at all!

4. Bad memories can also prevent you from confronting your finances and your path to success. You can get temporary relief by focusing your attention on present time, but for permanent solutions, use Dianetics.

By removing all four of these barriers, you have the potential to confront every aspect of your finances and earn the wealth you deserve.

Learn more about boosting your confront with “The Fear Problem.”

Learn more about boosting your income with “Five Ways to Increase Your Income.”